For many people, spending money is an addictive behavior similar to alcoholism or gambling. With compulsive spending, the true enemy is within. We need to replace our preoccupation with short-term gratification and make our spending decisions from a long-term perspective. We must replace our self-indulgence with self-control, which is a fruit of the Holy Spirit (Galatians 5:23). "Like a city whose walls are broken down is a man who lacks self-control" (Prov. 25:28). Without self-control on the inside, our lives are made vulnerable to innumerable assaults.

The following guidelines are designed to help you exercise self-control in spending. They can help you become a better steward of God's resources, and free funds to use for kingdom purposes:

1. Realize that nothing is a good deal if you can't afford it. $120 thousand dollars sounds like an excellent price on a house worth $150 thousand. Eighty dollars seems like a great deal on barely used skis that cost $400 new. But if you can't afford them, it simply doesn't matter. It's always a bad choice to spend money on a "good deal" you can't afford.

2. Recognize that God isn't behind every good deal. Suppose you can afford it. Does that mean you should buy it? Self-control often means turning down good deals on things we really want because God may have other and better plans for his money.

3. Understand the difference between spending money and saving money. Saving is setting aside money for a future purpose. Money that's saved stays in your wallet or the bank. It can be used for other purposes, including your needs or others'. Money that's spent leaves your hands and is no longer at your disposal. Remember that eighty dollar sweater on sale for thirty dollars? If you think you saved fifty dollars you still don't get it. Show me the fifty dollars you saved. It doesn't exist. Keep "saving" like that and you'll soon be broke!

4. Look at the long-term cost, not just the short-term. When you buy a nice stereo, you'll end up buying lots of CDs. When something breaks, you get it repaired. When you have an old car, you don't care about a dent. When you buy a new car you'll fret about dents and buy insurance to fix them. When you're given a "free" puppy immediately you're spending $20 a month on dog food, and the next thing you know you're putting $1,200 into a fence and paying $400 to the veterinarian to stitch up his wounds from a dog fight. Within a year or two, you may end up spending several thousand dollars on your free puppy. Count the cost in advance—everything ends up more expensive than it appears.

5. Pray before you spend. When something's a legitimate need, God will provide it. How often do we take matters into our own hands and spend impulsively before asking God to furnish it for us? How often do we go buy something—whether we consider it a "want" or a "need"—a week or a month before God would have provided it for free or at minimal cost, if only we'd asked him?

My friend wanted a good exercise bicycle. He even picked the exact model, a Tunturi model I was familiar with. I hadn't seen it sold at anything less than its retail price: $350. But instead of going out to buy it, he told me he was praying God would provide him that exact bike. By not spending the money, he would have more to give. A few days later I was in a thrift store and was stunned to see a Tunturi bicycle, that exact model. It looked like it had never been used. I called my friend. He got the exact bicycle he asked for, costing him $25 instead of $350.

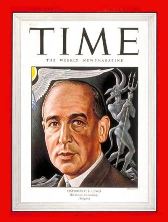

I did something similar when I finally gave up trying to purchase an original 1947 Time magazine with C. S. Lewis on the cover. I'd bidded for it on e-Bay a number of times, but it always moved out of a price range I was comfortable with. One evening, having lost another bid, I thought, "Lord, I'm wasting my time. I've asked you to help me win a bid, but I've never asked you to actually provide the magazine. It's a small thing, and I probably shouldn't want it this much. But I'm asking you for it. If you want me to have it, you're going to have to provide it at no cost."

I did something similar when I finally gave up trying to purchase an original 1947 Time magazine with C. S. Lewis on the cover. I'd bidded for it on e-Bay a number of times, but it always moved out of a price range I was comfortable with. One evening, having lost another bid, I thought, "Lord, I'm wasting my time. I've asked you to help me win a bid, but I've never asked you to actually provide the magazine. It's a small thing, and I probably shouldn't want it this much. But I'm asking you for it. If you want me to have it, you're going to have to provide it at no cost."

I was virtually certain I'd never have it, but I felt good giving it to the Lord. Some time later someone who'd read a few of my books, seeing how often I quoted C.S. Lewis, sent me the magazine in the mail. I couldn't believe it—then I remembered how I'd prayed for it.

Often we either buy what we want or forego what we want, when there's a third alternative: ask God to provide it for us. If He doesn't, fine—he knows best. But why don't we give Him a chance?

Waiting eliminates most impulsive buying. Many things that are attractive today hold no interest two months later. Look at garage sales and you get the picture. Setting a waiting period gives God the opportunity to provide what we want, to provide something different or better, or to show us that we don't need it and should use the money differently.

6. Examine every purchase in light of its ministry potential. Every time I spend money, I gain something and lose something. What I lose isn't merely money but what could have been done with the money if used in another way. When I spend twenty dollars on this object, a hundred on this one, and a thousand on another, I must weigh the value of these things against what the same money could have done if used another way—for instance, to feed the hungry or evangelize the lost.

I don't say this to induce guilt trips but to indicate the obvious—whenever money is used one way it prevents it from being used another. I must weigh and measure the various alternatives of how to use God's money. I sometimes choose to spend money on unnecessary things that still seem good and helpful. Sometimes I feel good about this; sometimes it seems questionable.

Often, however, there's a clear line we feel would be wrong for us to cross. For instance, we cannot justify spending thousands of dollars on jewelry when that same money could keep people alive or reach them with the gospel. We're not saying it's wrong for anyone else to have nice jewelry. We're saying that jewelry, like everything, must be subject to the scrutiny of conscience, the Holy Spirit, and God's Word. While you shouldn't impose your standards on other Christians, you should ask God to lead you.

7. Understand and resist the manipulative nature of advertising. Responsible spending says yes to real needs and no to most "created needs." We have far fewer needs than we believe. The temptation to overspending is immense. Advertising thrives on instilling discontent. Its goal is to create an illusion of need, to stimulate desire, to make you dissatisfied with what God has provided for you. People earn master's degrees in persuading us to buy things we don't need. Advertising enlarges our wants by telling us, "You need this car," "You won't be loved unless you wear these kinds of clothes," "You won't have fun unless you use this product."

Advertising is seductive and manipulative. It programs us. We must consciously reject its claims and counter them with God's Word, which tells us what we really do and don't need. We should withdraw ourselves from advertising that fosters greed or discontent. That may mean less television, less flipping through sales catalogs and newspaper ads, and less aimless wandering through shopping malls.

8. Learn to walk away from things you want but don't need. Once I received a large, unexpected check. After giving a certain amount to the Lord, I still had $2,000 left. Before long I was out looking at something I'd wanted but had never been able to justify. The price tag said $1,995. I looked it over, comparison shopped, came back the next day, and seriously considered buying it. But in my heart there wasn't peace when I considered what that money could do for God's kingdom. Finally, I decided I shouldn't make the purchase. When I turned and walked away something unexpected happened. I was suddenly filled with a deep sense of relief and joy. I hadn't realized how this item was possessing me. To be free of it was the first blessing; to know the eternal difference the money would make was the second.

9. Realize little things add up. Like water from a leaky faucet, money trickles through our hands. The little drips don't seem like much, but they add up to gallons. The dollar here and ten dollars over there, the hamburger here and the mocha there, the video rentals and rounds of golf and extra tools and clothes may seem inconsequential, but they add up to hundreds of dollars per month that could be used for kingdom purposes. If a swimming pool is full of leaks, you can pump in more water, but it will never be enough until the leaks are fixed. We can take in more and more income, but until we fix the little leaks in our spending habits, we'll never be able to divert the flow of money for higher purposes.

10. Set up and live by a budget. Imagine you entrusted a large sum to a money manager, telling him to take out only what he needed to live on, then wisely invest the bulk of it on your behalf. A few months later, you call him to see how the investments are coming. Embarrassed by your call, he admits, "There are no investments. None of your money is left." In shock you ask, "Where did it all go?" Sheepishly, your money manager responds, "Well, I can think of some expenses here and there, but for the most part I really can't say. There was this and that, and next thing I knew, it was all gone."

What would you think? How would you feel? How does God think and feel when at the end of the month nothing's left from the money he entrusted to us, and we don't even know where it went? If some of us ran a corporation and handled its money like we do God's, we'd go to prison!

"Be sure you know the condition of your flocks, give careful attention to your herds; for riches do not endure forever" (Prov. 27:23-24). Flocks and herds are the rancher's basic units of wealth. God is saying, know what your assets are and know where they go. "Any enterprise is built by wise planning, becomes strong through common sense, and profits wonderfully by keeping abreast of the facts" (TLB, Prov. 24:3-4).

We must get a grip on God's assets. If you don't have thought-out plans for what to do with God's money, rest assured that thousands of other people do have plans for it. If you don't harness it yourself, they'll end up with it and you'll end up with the stuff junkyards and garage sales are made of.

Two practical steps can greatly help you get a grip on your spending. The first is recording expenditures. The second is making a budget. These steps will help you detect problem areas by surfacing realities you weren't aware of. It will foster healthy discussion about what you do with money, and help you develop careful spending habits. This will improve your mental and marital health, since financial disorder is one of the leading causes of personal and familial stress.

For some, the most practical way to budget is the envelope system. Paychecks are cashed. The cash goes into envelopes with designations written on them: Food, gas, garbage, entertainment, clothing, etc. If it's the tenth of the month and nothing's left in the entertainment envelope, no more movies or eating out. If you overspend in one area you must underspend elsewhere to compensate. (But if you spend the clothing money instead, it's going to catch up with you when you need to buy clothes.) The envelope system teaches there's a bottom to the well, that resources are limited. That's an invaluable lesson.

I recommend you pick up one of the practical books on finances that deals with budgeting.i Such books show how to make a careful record of expenditures so you can find out where your money's going. Meanwhile, you can determine where you think it should be going. This will be the basis for your budget, which will include how much you've determined to give and to save, and how much is available for spending.

Living on a budget will free up lots of money. I've met with families that follow a budget and do fine on incomes of $12,000 a year. I've met with others who make $20,000 a month and are always in financial crisis. It's not how much money we make, but how we handle it that matters.

For more on this subject, see Randy Alcorn's book Money, Possessions and Eternity.

i I recommend Ron Blue's Master Your Money (Nashville, TN: Thomas Nelson, 1986); Larry Burkett's Your Finances in Changing Times (San Bernardino, CA: Campus Crusade for Christ, 1975); Howard Dayton's Your Money: Frustration or Freedom (Wheaton, IL: Tyndale House, 1979); and Malcolm MacGregor's Your Money Matters (Minneapolis, MN: Bethany House, 1980).